Credit Cards

Explore Our Cards and Apply Online

Report Your Credit Card Lost or Stolen

- Contact: (866) 820-3865

- Outside the US: (303) 967-7096

- 24-hr assistance: (866) 820-3865

CU Rewards Website

VISA Credit Card Options

| Type: |

Platinum |

Platinum Rewards |

Platinum Secured |

|---|---|---|---|

| Annual Fee | NO Annual Fee | NO Annual Fee | NO Annual Fee |

| APR for Purchases | 2.99% Introductory Rate for first 6 Months; Non-Variable 8.99%–19.99% following introductory period |

2.99% Introductory Rate for first 6 Months; Non-Variable 9.99%–20.99% following introductory period |

8.99% Non-variable |

| APR for Advances* |

8.99% to 19.99% Non-Variable |

9.99% to 20.99% Non-Variable |

Not Available |

| Balance Transfers | 2.99% Introductory Rate for first 6 Months; Non-Variable 8.99%–19.99% following introductory period NO Balance Transfer Fee |

2.99% Introductory Rate for first 6 Months; Non-Variable 9.99%–20.99% following introductory period NO Balance Transfer Fee |

Not Available |

Subject to credit approval. Rates are current as of April 27th, 2024.

APR= Annual Percentage Rate. *Cash advance fees of $10 or 2.00% of advance amount, whichever is greater, will apply. Foreign Transaction Fee: A fee of 2.00% of each transaction (in U.S. Dollars) will be assessed for any purchase or cash advance outside of the United States. Additional fees may apply. Rates are subject to change without notice. Check our fee schedule for details.

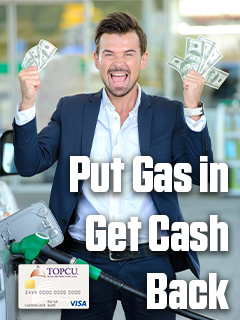

Platinum Rewards

Accumulate points for the dollars you spend. You’ll earn at least one point for every $1 you spend. When you’re ready, you can redeem your points for valuable rewards. Redemptions start at just 2,500 points so make every dollar count more.

- Earn 1 Point For Every $1 You Spend

- No annual cap on points earned

- No rewards limit

- No rewards expiration while account is open

- No redemption fees, no limits, and points that never expire

- Travel Rewards — Airline flights, hotel stays, car rentals and cruise vacations

- Valuable Merchandise — Appliances, jewelry, electronics, household goods

- Cash Back — Redeem your points for cash*

- + More

- Cash rewards can be issued either as a credit to your credit card or to any deposit account at TOPCU

- Cash rewards require a minimum of 5,000 points to redeem

- As few as 5,000 points = $50 cash back

- Visit curewards.com and log on using a separate username and password

- For travel awards, call the CURewards travel agency at 800.900.6160

- For merchandise awards, complete and return the order form at curewards.com. You’ll receive your reward within four to six weeks

CU Rewards Website

Once you get your TOPCU credit card, don’t forget to protect your account by registering with VISA Purchase Alerts. Click here to sign up today!

Visa Purchase Alerts

Sends you real-time* email alerts when you pay with your TOPCU Visa card.

Stay Informed

Sign up for text or email alerts for extra security. Learn more

Visa Purchase Alerts

Three Steps to Enroll

You’ll get real-time alerts whenever your purchase meets the criteria you selected during enrollment.

Step 1

Check to see if your card is eligible.

It will then tell you if the card is eligible and ask you to create an account. Follow the steps.

Click here to sign up for Visa Purchase Alerts today.

Step 2

Register your mobile device and email to receive Visa Purchase Alerts.

Step 3

Choose the notification triggers that match your needs, such as transactions exceeding a set amount.

Contact us at (520) 881-6262, ext. 702 to learn more.