Mobile Deposits Frequently Asked Questions

Who’s eligible for mobile deposits?

Members with a checking, savings or money market account who are over 18 years old and in good standing for a sufficient history with TOPCU are eligible to make mobile deposits.

What mobile platforms support mobile deposits?

Mobile deposits are currently available on:

* iOS® 10.0 and above (iPod Touch® 5th generation, iPhone® 4GS and above, iPad® 2 and above)

* Android® OS 5.0 and above

How to submit a mobile deposit?

Start by opening your app, signing into your account, and selecting ” Deposit Check.”

Choose the account where you want your deposit to go, then enter the amount.

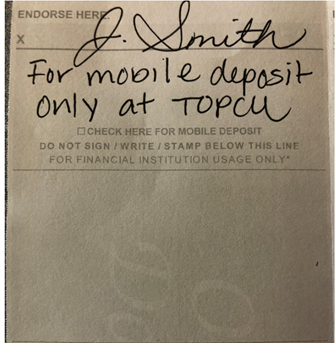

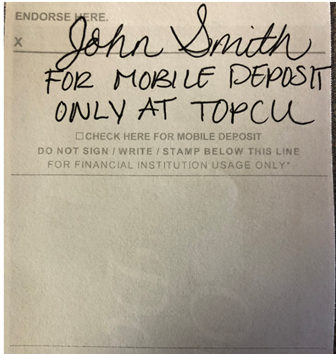

Be sure to Sign the back of your check and write “For mobile deposit only at TOPCU”.

Now, it’s picture time, tap: “Front of check”

Then, hold the device directly over the check and we’ll take the photo for you.

Once both sides are captured, tap “Submit Deposit,”

You’ll immediately get a message that your deposit is processing.

You can deposit another check or tap Done.

Funds are generally available the next business day.

Are there fees associated with mobile deposits?

Mobile deposits are free for members making deposits to their eligible accounts. Charges for returned deposits and other transactions are outlined in the Fee Schedule.

Is my financial information safe with mobile deposits?

Yes. The mobile deposits feature is offered through our Mobile Banking app, which requires you to provide a unique Access Number or username and password each time you sign in.

Is there danger of fraud while using mobile deposits?

We require each item to be endorsed with the signature of the payee and the phrase “For Mobile Deposit Only at TOPCU”. This way, checks deposited using mobile deposits can’t be deposited again at a TOPCU branch or another financial institution. The mobile deposits approval process also includes a review of each deposited item and automatically detects duplicate deposits.

When will deposited funds be available in my account?

Items transmitted using this Service are not subject to either the funds availability requirements of Federal Reserve Board Regulation CC or TOPCU’s funds availability schedule contained in the Important Disclosures booklet. Below is our general funds availability schedule for this Service:

| If you submit your deposit within the below timeframes: | Up to $225 is available: | Remaining funds of deposits up to $5,525 are available: | Remaining funds of deposits between over $5,525 are available: |

| Monday-Friday, prior to 4:00pm CT | After the deposit is approved |

Second Business Day after day of approval | Seventh Business Day after day of approval |

| Monday-Friday, after 4:00pm CT Saturday-Sunday |

After the deposit is approved |

Third Business Day after day of approval | Eighth Business Day after day of approval |

| Federal Holiday | After the deposit is approved |

Third Business Day after day of approval | Eighth Business Day after day of approval |

You will only receive one (1) $225 credit per Business Day, even if you deposit more than one check using the Service. Deposits made on weekends or Federal Holidays are considered received on the next Business Day, but as a member service you will receive the $225 credit upon approval of the earliest deposit. For example, if you make one deposit on Saturday, one on Sunday, and another on Monday, you would still only receive one (1) $225 credit on Saturday, as all three deposits would be considered received on Monday.

What are the deposit and transaction limits?

Personal and Business dba accounts have a 10-check-per-day limit and a total dollar amount limit of $1,500 per day.

Commercial accounts have a 10-check-per-day limit and a total dollar amount limit of $5,000 per business day.

What types of checks can I deposit with mobile deposits?

We accept any of the following types of checks:

* Personal checks

* Corporate/business checks

* Cashier’s checks

What types of checks can’t be deposited with mobile deposits?

The following items are not eligible for mobile deposits:

* Checks payable to any person or entity other than you;

* Post-dated checks;

* Checks or items containing an obvious alteration to any of the fields on the front of the check;

* Checks which you know or suspect, or should know or suspect to be fraudulent;

* Checks written or issued from any TOPCU account on which you are a primary or joint owner;

* TOPCU credit card convenience checks;

* TOPCU convenience checks;

* Checks or items not payable in United States currency;

* Checks or items drawn from financial institutions located outside the United States;

* Checks or items previously converted to a substitute check (image replacement);

* IRA or Share Certificate deposits;

* Money orders and traveler’s checks;

* Starter or counter checks;

* American Express® (AmEx) Gift Cheques;

* Savings bonds;

* Checks that require phone calls for authorization codes;

* State-issued registered warrants;

* Insurance checks made payable to the member and TOPCU; or

* Checks from a closed account at another financial institution.

How long does the system retain my mobile deposits history?

You can view a history of your mobile deposits and check images for 60 days.

How long should I retain my original check?

For your protection, retain the original check for 2 weeks (unless otherwise directed by the instructions contained in the approval email).

How do I endorse my check to make a successful deposit?

On the back side of the check you must sign your name and under your name the words clearly and legibly need to say “FOR MOBILE DEPOSIT ONLY AT TOPCU” above the line that instructs you not to sign write or stamp below of.

Why do I have to endorse the check with the words “For Mobile Deposit Only at TOPCU”?

This specific endorsement ensures that checks deposited through the Mobile Deposits app won’t be deposited again at a TOPCU branch or at another financial institution. It’s one of many security measures we’ve put in place to protect consumer, business and commercial accounts from theft and fraud. Checks that aren’t endorsed as specified will be rejected.

What should I do if I need help using mobile deposits?

The mobile deposits feature is designed to be a user-friendly, self-service product. If you have trouble using it, call us at 1-520-881-6262 <tel:1-520-881-6262> for assistance.

What should I do if my mobile deposit is declined?

If your deposit is declined, we’ll send an email to your email on file explaining why. If you feel you need to discuss the matter in more detail, call us at 1-520-881-6262 <tel:1-520-881-6262> for assistance.

*Credit given for the item is provisional and subject to final approval of the item. Funds you deposit may be delayed for a longer period of time when we have reasonable cause to believe the check is uncollectable. We’ll notify you if we delay your ability to withdraw funds because we believe the check is uncollectable, and we’ll tell you when funds will be available. You agree to receive all notifications regarding your use of this service via electronic message. With respect to each item you send to TOPCU for deposit, you agree to indemnify and reimburse Tucson Old Pueblo Credit Union for and hold TOPCU harmless from and against any and all losses, costs and expenses.

Android™, Google Pay™ and Google Play™ are trademarks of Google LLC. The Android Robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. App Store®, Apple®, Apple Pay®, iPhone®, iSight®, Wallet®, Touch ID®and iTunes® are trademarks of Apple, Inc.

American Express is a registered service mark of American Express.