Your Credit Score

Your Credit Score

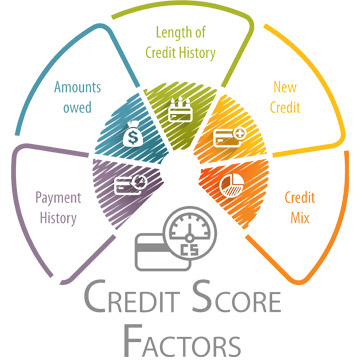

Multiple factors are considered in determining your credit score. While each version of your score is a little different, the most common formulas are determined with the following:

- Payment History – 35%

- Credit Utilization – 30%

- Length of Credit History – 15%

- New Credit – 10%

- Types of Credit – 10%

Payment History – Your late versus on-time payments make up the greatest portion of your credit score. More recent late payments affect your score more than older late payments. Additionally, scores will look at your overall history of paying. If you have multiple accounts in perfect condition, a single late payment will hurt your score less than if someone only has one account with the same late payment.

TOPCU has a bill pay system you can utilize to ensure your payments arrive on time and avoid late payments. Ask our service team for more information.

Credit Utilization – Your utilization is about your outstanding balances and available credit. In addition to your overall debt balances, your ratio of revolving debt and number of maxed out cards is important to this factor. A credit card is considered maxed out when at or near the credit limit on the card. If you have a maxed-out credit card, you’re going to see a decent dent in your score. Multiple cards maxed out will crater it.

Conversely, rumors abound about needing to carry a certain balance, usually 10-30%, to see greater benefits from your credit card on your score. These are unfounded. Your best bet to improve your score is to keep your credit utilization as low as you can, while continuing to make on-time payments.

Length of Credit History – The age of your accounts also plays an important factor in your credit report. Your Length of Credit History applies to currently open or reporting accounts, so the loan you took out and paid off 20 years ago is not affecting your modern score. Most scores look at the age of your oldest reporting account, as well as the average age of your accounts.

Your credit history and credit utilization are what causes your score to go down when you close a credit card. Closing a card obviously reduces your credit available, but if you also close an old card, that will shorten your credit history. While you may think it’s best to keep a card open for this reason, we recommend talking with one of our Financial Counselors to figure out the best option for you in the long run.

New Credit – Length of credit history also ties into the next category, New Credit. Having a new account opened will reduce your score, and multiple new accounts drop it more. In addition, credit inquiries (or times you’ve applied for new credit) is also tracked. Hard inquiries like this will have less of an effect on your score after one year and will drop off your report entirely after two.

Types of Credit – Lastly, we have the mix of credit accounts that make up your credit history. Having a mix of credit cards, auto loans, installment loans, mortgage or other debt is preferable to having only one type of debt, such as only having credit cards. Maintaining a mix of debt is important for a credit boost.

Exactly how much any single event in any of these categories will affect your score is difficult to measure accurately. The algorithms that determine these scores are proprietary and hidden. Your best bet is to ensure you pay your debts on time, and only take out loans when you absolutely have to.

51% of TOPCU’s employees are certified as financial counselors, this allows us to offer additional benefits to our membership. The financial counseling is offered for free for TOPCU members and is designed to assist a variety of financial situations. Financial counselors cannot give specific advice regarding investments (though our Financial Advisor can) or taxes. However, we can help point you in the right direction.

Members will work with a counselor to create an action plan based around their goals. This may be someone just starting to build their credit or someone that needs a little help to get back on the right track after a financial setback. It could also be someone who just wants to know they are making good choices.

What is a CCUFC?

A Certified Credit Union Financial Counselor (CCUFC) is a designation given to those who are specially trained in assisting our members to understand their financial situation and develop solutions. Subjects include budgeting, saving, and reducing expenses. The course is designed to help improve the financial wellness and literacy of our members and to help give them the tools to develop their financial standing.

Have questions? Ask us!