✦ Trusted Since 1935

Tucson Old Pueblo Savings Accounts

Savings options for every stage of your financial journey, whether you’re just getting started or ready to step up and earn more.

Competitive Rates

We’re not-for-profit so we can offer higher savings accounts interest rates and dividends.

24/7 Access

Manage your savings account using Online and Mobile Banking or our call us or stop by a branch.

Federally Insured

Your deposits are insured by NCUA up to $250,000 so you don’t need to worry about the markets.

Easy to Open

Simply check if you’re eligible click join TOPCU then get started with a $5 deposit.

Regular Share Savings

Become a member and part-owner of the credit union with this simple savings account designed to kickstart your financial future. Deposit $5 in your TOPCU Share Savings Account and gain access to all our products, services, and member benefits.

- Open multiple Regular Share Savings to achieve different goals.

- Online savings accounts offer easy transfers using Online Banking and our Mobile app.

- Access your funds immediately.

Rise High Yield Savings

Ready to see your savings rise? Open a Rise High Yield Savings account today and start enjoying the benefits of a 3.45% APY*.

- No minimum balance or deposit necessary.

- Earn 3.45% annual percentage yield APY*

*APY = Annual Percentage Yield. No minimum balance required. Rise High Yield Savings account annual percentage yield (APY) Rates are subject to change after account opening. Rates are current as of April 10th, 2025. and subject to change.

Money Market Savings

A Money Market Account at TOPCU rewards higher balances with a tiered rate structure. These financial products offer higher returns* than traditional savings accounts or short-term certificates of deposit. Plus, you can add money anytime.

- Pay no monthly maintenance fee.

- Earn competitive, guaranteed rates.

- Tiered interest rates mean your rate goes up as your balance grows.

The rate may change any time after the account is opened. Rates are subject to change without notice. Account fees could reduce the earnings on the account.

Youth Savings

TOPCU offers a Youth Savings aka TOP STAR account for youth between the ages of 1 and 17. These accounts help Tucson youth learn valuable money management skills so they’re well-equipped for the future.

- The minimum initial deposit is just $0.

- A qualified adult TOPCU member is required to open an account and serves as the joint owner.

- Youth can learn about deposits, withdrawals, and interest rates.

- They can save up for things they want to buy or start building a nest egg for the future.

Share Certificates

Certificates typically offer 10 to 30 times the return of a regular savings account. In addition, your earnings aren’t affected by unpredictable market activity. All you need to do is agree to leave your funds untouched for your preferred term.

- Earn higher interest rates than other savings accounts, including Money Market investments.

- Open an account with a low minimum deposit of $1000.

- Choose a term from six months to five years.

Rates are subject to change without notice. Dividends are paid and compounded Monthly from date of deposit and are available for withdrawal. Penalty for early withdrawal will apply. Fees could reduce the earnings on this account.

IRA Accounts

An Individual Retirement Account (IRA) is a straightforward way to begin saving for your future. This savings account is an excellent option if you do not have a workplace-sponsored plan, or you may choose to open an IRA in addition to your 401(k) or similar.

With TOPCU, you can choose between an IRA Savings or an IRA Share Certificate. You also have the option of selecting a Traditional IRA, Roth IRA, or Educational IRA.

- IRA Savings: Benefit from tax advantages and save for your retirement with annual contribution limits.

- IRA Certificate: A certificate account that allows you to earn higher dividends on your IRA funds.

The rate may change any time after the account is opened. Rates are subject to change without notice. Account fees could reduce the earnings on the account.

✦ All About Accessibility

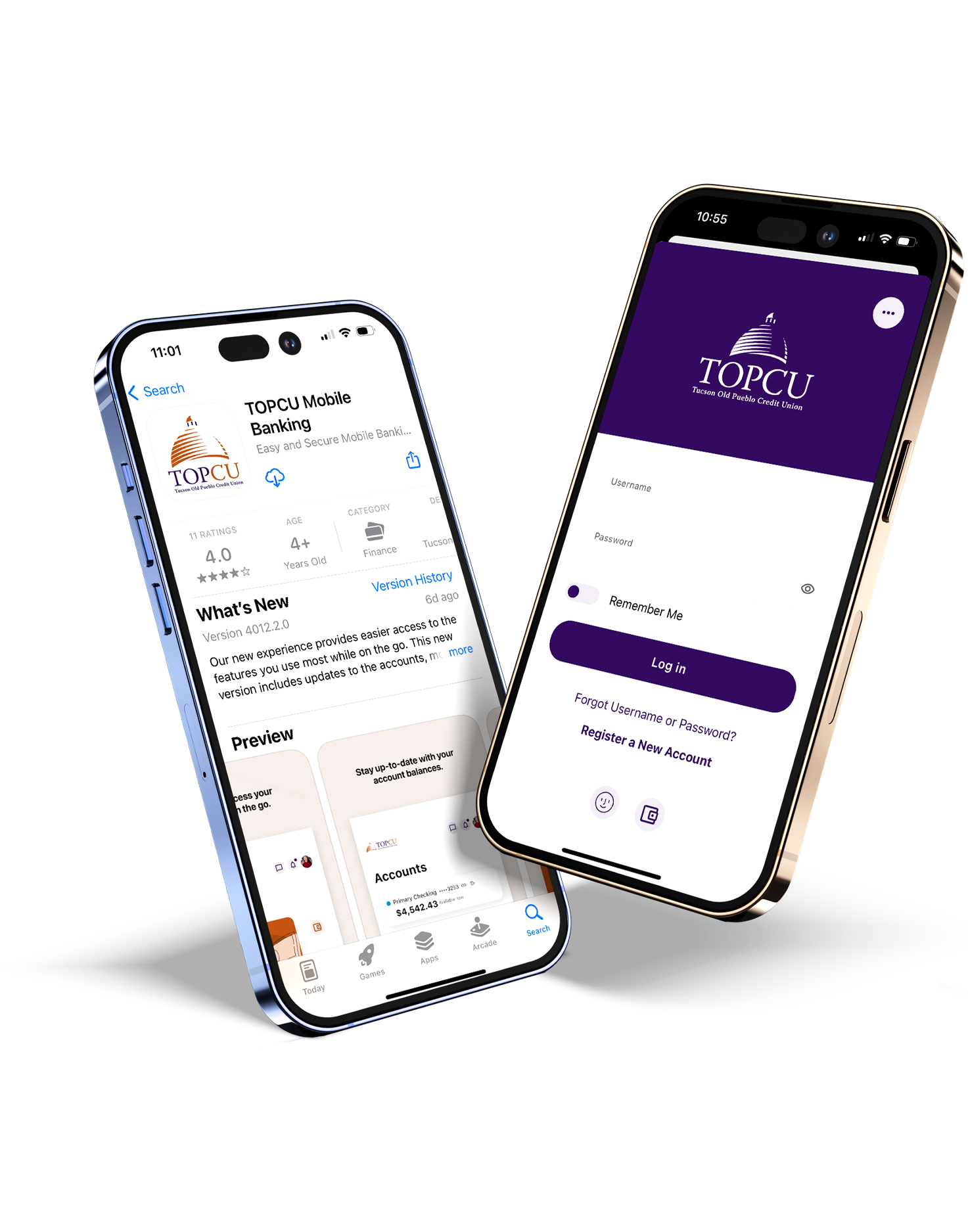

Revolutionize Your Banking with The TOPCU App

Check deposits, loan payments, and fund transfers are at your fingertips. Plus, get insights into your spending, access your credit score, and link all your external accounts for a full financial picture.

Your Choices, Your Finances Discover

Savings

High-yield savings to maximize your financial growth

Checking/Debit

Earn rewards with every transaction you make.

Investments

Grow your wealth with personalized investment solutions.

Solar Loans

Finance your eco-friendly solar projects easily.

Free Credit Score

Instant access to monitor your financial health.

Auto Loans

Competitive rates for new or used vehicles.

This Week’s Rates

4.30% APY*

6-Month Certificate of Deposit

3.45% APY*

Rise High Savings Account

5.79% APR*

Auto Loans

2.99% APR*

Credit Card Into Rate

✦Trusted Since 1935

Join a Thriving Community

TOPCU isn’t just a credit union; it’s a community.

Trusted by 20000+ around in the greater Tucson community

Rob Foster

Google Review

Best bank I’ve had. Excellent customer service

Rebecca Lebsack

Google Review

I can’t say enough GREAT things about this bank. The employees are soooo friendly and I always leave in high spirits. They have always provided over the top customer service and will ALWAY’S go above and beyond for their customers. Thank you TOPCU for making me feel like family.

Cabins Management

Google Review

As much as I would LOVE to keep Tucsons best kept secret all to my self, that would be doing injustice for these wonderful employees. Ken and Jamie both went above and beyond with helping secure and finalize our loan. I could not have asked for a better experience with a credit union. I have dealt with many loan officers and financial institutes spanning across the state of Arizona

Join The Growing Community of Individuals & Businesses Across Tucson

Tucson Old Pueblo Credit Union opened its doors in 1935. Through the years, TOPCU has expanded services and our field of membership to serve the greater Tucson community.

Is TOPCU a Bank?

TOPCU is a not-for-profit organization that exist to serve Tucson members. Like banks, we offer direct deposit, debit cards , checking accounts, credit cards, loans, and provide a wide array of other financial service

What is a credit union?

1. Credit union resources are returned to you the member in the form of lower fees.

2. Credit unions are a more personalized way of handling personal finance; you will have a better chance at securing personal and small business loans at your local credit union.

3. Credit unions’ interest rates are lower compared to big bank rates. And, free checking is alive and well. Deposits are insured by the National Credit Union Share Insurance Fund.

4. Through CO-OP Network, members have the nation’s largest network of credit union ATMs – 28,000 surcharge-free locations (9,000 of which accept deposits)!

Can I make Payments Online?

1. Log-in to Online Banking.

or

2. Set up new electronic transfers from another financial institution by providing the following:

TOPCU’s Routing Number:

13-digit number comprised of your account code, loan ID, and member number formatted as follows:

First Digit Account Code: 2 (for loans)

Next 2 digits: Loan ID

Last 10 digits: Membership number preceded by zeros (For example, for the solar loan of member# 0000123456 with loan ID #70, you would enter 2700000123456)

or

3. Mail your payment to: Tucson Old Pueblo Credit Union – 2500 E 22nd Street, Tucson, AZ 85713

4. Visit any of our branches.

Do you offer Skip a Pay?

Yes on all eligible loans .

Home Banking App Who’s Ready for Better?

With TOPCU’s home banking app, better is not just a promise—it’s a reality. Experience a suite of features designed to make your financial life easier and more secure.