Why Combine TOPCU Rewards Checking with Rise High Yield Savings?

Maximize Earnings:

Our TOPCU Rewards Checking account, with its rewarding cashback on every debit transaction and no fees, complements the high-yield returns of our Rise Savings Account. This combination ensures your money is not only safe but also growing.

Convenience and Accessibility

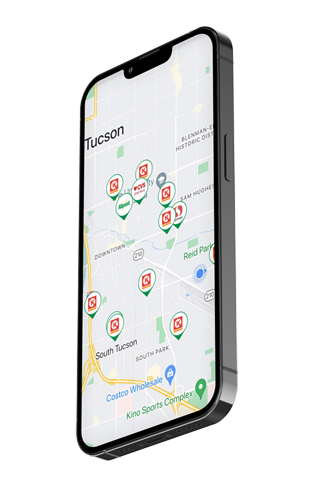

With over 70 free ATMs across Tucson, the Rewards Checking account offers unmatched accessibility. Meanwhile, the Rise High Yield Savings account brings the benefit of a 3.00% APY, making your savings grow faster.

Fee-Free Banking

Enjoy the perks of banking without worrying about monthly fees or minimum balance requirements. Our goal is to make banking simple and cost-effective for you.

# Swipe Your Way to Checking Rewards

How many times do we use our cards or digital wallets in a day? From the morning coffee run to the lunchtime grab-and-go, online shopping sprees to utility bill payments, every swipe, tap, or click has become an integral part of our daily lives. But what if each transaction could give you more than just an exchange of goods or services?

With our Rewards Checking account, every transaction you make earns you money. For the first two months, you get 10 cents back for every transaction. But the rewards don’t stop there. After the first two months, you continue to earn 5 cents back on every transaction.

-

Earn 10 cents for every debit transaction for the first two months.

-

After the first two months, you continue to earn 5 cents back on every transaction.

Rise to Greater Savings

The Rise High Yield Savings account, offering a significant 3.00% APY, is a game-changer for savers. Without any minimum balance or deposit constraints, it’s an ideal choice for growing your savings effortlessly.

With every swipe, tap, or click, you’re not just making a transaction; you’re writing a new chapter in your financial journey. Start your journey with our Rewards Checking account today, and let every transaction become a reward on your financial path.

No fees

No worries

No monthly or maintenance fees—what you earn is what you keep

$0

No minimum

There’s no minimum to open

Why open a Checking account with TOPCU?

A TOPCU Checking Account can help you make progress with your money.

| Financial Institution | Monthly maintenance fee | Monthly daily balance to waive monthly fee |

| TOPCU | $0 | $0 |

| Wells Fargo2 | $10 | $500 |

| Bank of America3 | $12 | $1,500 |

Have questions? Call us: (520) 881-6262

Are you ready to supercharge your Checking and Savings Account?

Manage your money on the go.

Bank almost anywhere, anytime with our top-rated mobile banking app and easy-to-use digital tools. It’s all right at your fingertips

60,000+ fee-free ATMs nationwide

Access your money when you need it with fee-free ATMs1 at stores like Walgreens®, 7-Eleven®, Target®, Circle K, and CVS Pharmacy®.

Have questions? Contact Us

Ready to make the SWITCH?

You’ll be glad you made the decision to switch to TOPCU! The process is as easy as visiting any of our branch locations. Our member services team will be happy to assist getting you signed up. You can also reach us by email at info@topcu.org or by phone at (520) 881-6262 ext. 702 or toll-free at (800) 440-8328.

Checking Account Types

| Type: |

Rewards Checking |

Classic Checking |

Mission Checking |

|---|---|---|---|

| Best For: | Members who use debit card frequently and carry low checking account balances | Members who carry higher balances and want to earn interest with full liquidity plus unlimited transactions | Members who want a fresh start with their finances |

| Opening Deposit Requirement | None | None | $20 |

| Monthly Fee | None | None | $20 |

| Interest-Earning | Earns interest on balances over $2,500 | Earns interest on balances over $2,500 | None |

| Online Banking | Free Online Banking and Bill Pay | Free Online Banking and Bill Pay | Free Online Banking and Bill Pay |

| ATM Transactions | Free at all in-network ATMs (Out-of-network fees apply) |

Free at all in-network ATMs (Out-of-network fees apply) |

Free at all in-network ATMs (Out-of-network fees apply) |

| Check Discounts | Free basic checks (first box ONLY) | Checks at cost | None |

| Debit Card | Free and earns $0.05 for each debit card transaction | Free | FREE – Direct deposit required for debit card |

| Direct Deposit | Not required | Not required | Not required |

| Monthly Statements | eStatement required | Choice of paper for $2.50 or FREE eStatements | Choice of paper for $2.50 or FREE eStatements |

*All members must open a basic savings account and maintain a $5 minimum balance.

1 Out-of-network ATM withdrawal fees may apply except at any Allpoint ATM.

2Source: Wells Fargo Everyday Checking as of July 2022.

3Source: Bank of America Advantage Plus Banking as of July 2022.

Have questions? Ask us!

Have questions? Call us: (520) 881-6262

See our Account Disclosures for details.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

If you are using a screen reader, or having trouble reading this website, please call us for help at (520) 881-6262